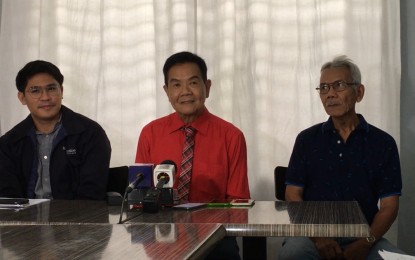

Dr. Jaime Galvez Tan (center) calls on the public to be vigilant on the implementation of the higher tobacco tax bill.

MANILA -- Health advocates on Wednesday urged the public to be vigilant on the implementation of the higher tobacco tax bill.

"We are happy on the approval of increased tobacco tax because it would decrease the number of new smokers and the Universal Health Care (UHC) program would have additional fund, but we need to watch over the implementation of this bill because if there is one product which shouldn't exist on earth, that is tobacco," Health Justice board member Dr. Jaime Galvez Tan said in a press conference in Quezon City.

Health Justice PH is an advocacy group with legal expertise in tobacco control and public health promotion.

Galvez, a former health secretary, said their tax tobacco to the max campaign aims for the PHP60 to PHP90 increased tax per pack of cigarette but they welcome the PHP45 to PHP60 increase as it would still impact the health of the Filipinos.

AKTIB community leader Erning Ofracio said the poor, who are "the most vulnerable members of the society", would benefit from the initiative because it makes cigarettes less affordable to them.

"Marami sa amin ay namamatay na lamang sa kanilang mga bahay, madalas walang gamot na libreng dumarating sa aming mahihirap, kaya malaki ang aming pasasalamat sa mga miyembro ng Sin Tax Coalition na nagpursige. Hindi na kami mag-aalala na ang susunod na henerasyon ay lalaking maysakit na tuberculosis, cancer o diabetis dahil sa nicotine ng sigarilyo (Many among us simply die in their houses, no free medicines for poor people like us, that's why we're grateful to the Sin Tax Coalition members who persevered. We won't be worrying about the new generation growing up with tuberculosis, cancer or diabetis because of the cigarette's nicotine)," Ofracio added.

Lawyer Benedict Nisperos, legal consultant of Health Justice Philippines, said the delay on the approval of the bill shows the "strong influence of the tobacco industry in Congress".

Nisperos said their group, together with other health advocates, would safeguard the implementation of the bill and work on additional measures leading to a tobacco-free Philippines.

"We're pushing, in the next Congress, for the increase of age of accessibility of tobacco products to 25 years old, removal of the tobacco companies from the Framework Convention on Tobacco Control, expansion of public places where smoking is prohibited, and increase in the excise tax coverage," he added.

The Senate on Monday approved on third and final reading the excise taxes on tobacco products.

It passed Bill 2233 seeking an increase in excise tax for every cigarette pack from the current PHP35 per pack to PHP45 by 2020, PHP50 by 2021, PHP55 by 2022, and PHP60 by 2023. These will be followed by 5 percent tax increase by 2024 in a yearly basis.

The tobacco growing provinces will still get their share from the sin taxes while the biggest percentage would fund the UHC law implementation.

According to the Department of Finance, the PHP45 to PHP60 increase for the next four years would result in PHP15 billion additional fund for the UHC. (PNA)