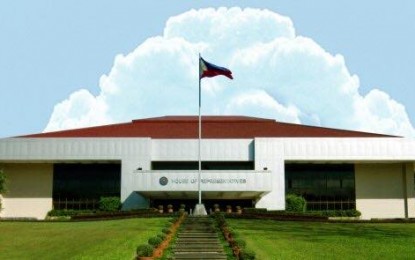

MANILA – A measure seeking to provide financial assistance to distressed enterprises critical to economic recovery in the aftermath of the coronavirus disease (Covid-19) crisis hurdled committee level at the House of Representatives on Friday.

The House Committee on Banks and Financial Intermediaries, chaired by Quirino Rep. Junie Cua, approved House Bill 6795, or the proposed Government Financial Institutions Unified Initiatives to Distressed Enterprises for Economic Recovery or GUIDE Act.

The bill aims to strengthen the capacity of government financial institutions --Philippine Guarantee Corporation (PGC), Land Bank of the Philippines (LBP), and the Development Bank of the Philippines (DBP) -- to provide the needed assistance to micro, small, and medium enterprises (MSMEs), and other strategically important companies.

These government financial institutions shall be mandated to expand their credit programs to assist affected MSMEs to meet their liquidity needs.

Cua, who also authored the bill, said MSMEs play an important role in the economic recovery and overall employment in the country.

"Enterprises, whether MSMEs or large enterprises, were heavily impacted by the disruption in travel and transport of goods and services as a result of the Covid-19 outbreak," Cua said.

"These enterprises which belong to or operate in certain industries or sectors that are strategically important to economic recovery would require financial assistance, in order to ensure their continued viability, and, in turn, create a ripple effect to reverse the economic downturn," he added.

The bill also authorizes LBP and DBP to create a special holding company, which aims to further reinvigorate these strategically important companies heavily affected by the pandemic.

Equity participation in the special holding company may be held by qualified private sector investors, but LBP and DBP will have to maintain at least a majority ownership over the firm until such time that they have recovered their investment.

Cua said the special holding company is intended to be a "major player" in the financial and capital markets by providing aid to strategically important companies with liquidity issues brought about by the Covid-19 pandemic.

The special holding company shall be authorized to invest or place funds in equity, execute convertible loans or purchase convertible bonds and other securities, in strategically important companies, as well as to incorporate subsidiaries.

To increase the capitalization of these government financial institutions, the bill seeks to appropriate PHP5 billion to PGC as additional capital, and PHP50 billion shall be infused as additional capital to LBP and DBP. (PNA)