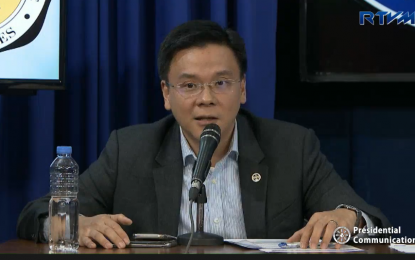

Finance Assistant Secretary Antonio Joselito Lambino II

MANILA – Small business owners are encouraged to register with the Bureau of Internal Revenue (BIR) not because the government merely wants to collect taxes but for them to be accounted for and be included in its programs for the sector.

During the Laging Handa PH briefing on Tuesday, Finance Assistant Secretary Antonio Joselito Lambino II said registered small businesses with an annual revenue of PHP250,000 are exempted from paying income tax.

Lambino said the law provides tax exemptions for small businesses so there is no reason for the owners not to register and violate existing rules.

“We just want them to follow the law. That is actually applicable to everybody doing business,” he said.

Lambino said BIR-registered businesses may also be included in the various programs for this sector, such as the small business wage subsidy (SBWS) program extended to workers of firms affected by work stoppage during the implementation of the enhanced community quarantine (ECQ) from mid-March to mid-May this year amid the coronavirus disease 2019 (Covid-19) health crisis.

He said the Department of Trade and Industry (DTI) also has loan programs for these firms.

“So it’s (registering a business) not only a requirement and an act of good citizenship. It also comes with benefits,” Lambino added.

Last June 1, the BIR issued Revenue Memorandum Circular (RMC) 60 2020 urging online businesses to register with the bureau or update their registrations, a move that is part of the government program to tax digital transactions.

These businesses are given until June 31, 2020 to register or update their registration so as not to be slapped with penalties. (PNA)