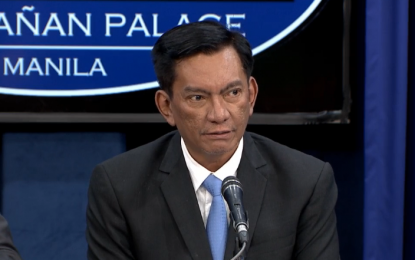

Albay Rep. Joey Salceda (file photo)

MANILA – The chairman of the House Ways and Means Committee on Tuesday said the newly-launched unified registration portal for applicants for tax incentives would help fast-track applications, reduce the amount of administrative discretion, and promote more investments.

In a statement, Albay Rep. Joey Salceda said the Fiscal Incentives Registration and Monitoring System (FIRMS), a unified online registration and incentives application portal for investors or enterprises to submit and monitor applications for incentives in any of the investment promotion agencies, was created following the effectivity of the Corporate Recovery and Tax Incentives for Enterprises (CREATE) law.

“Now that there is a unified registration portal for applicants for tax incentives under CREATE, it should be easier for investors to get tax incentives if they are qualified. This adopts best practice from countries such as Singapore where the investment promotion framework is already very sophisticated,” he said.

Salceda said the portal would also help keep better track of investment commitments.

“Of course, investors do not get tax incentives from us for free. They have to actually follow through with their investment commitments, create the jobs they say they will generate, and yield the economic benefits they say they can put up,” he added.

Under CREATE, any material misrepresentation to attain more tax incentives than the applicant is entitled to is punishable with a clawback clause that allows the government to recover the excess tax incentives.

Salceda said the portal has a feature that makes remote applications easier, which would boost small-scale foreign direct investments (FDIs).

“If you’re a foreigner and you are not physically present in the Philippines, this also makes applications much easier, since you no longer have to retain someone in the country to do the paperwork for you,” he added.

Salceda said the aim of the law was to attract FDIs regardless of size.

“There are small enterprises that are actually very promising startups. We want them, too. But they are unable to maintain physical agents processing their applications in the Philippines. This portal makes it easier for them to do business in the country,” he said. (PNA)