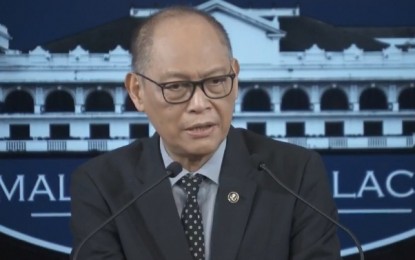

MORE TIME. Finance Secretary Benjamin Diokno wants to give tax measures implemented during the Duterte administration “more time” to really see their gains. His reaction was made when asked for his thoughts on the proposed Tax Reform Act for the Masses and the Middle Class filed by ACT Teachers Representative France Castro. (PNA file photo)

MANILA – Department of Finance (DOF) Secretary Benjamin Diokno discounts the need to introduce further reforms in both the personal and corporate income tax systems, noting these have been amended a few years back.

“We just amended both PIT (personal income tax) and CIT (corporate income tax). Let’s give the new tax systems a chance to operate. Too early to tinker with it,” he told journalists on Wednesday.

Diokno’s reaction was made in response to the proposed measure by ACT Teachers Representative France Castro titled Tax Reform Act for the Masses and the Middle Class (TRAMM), which according to the press release from the lawmaker, “aims to address imbalances brought by regressive tax reform laws, such as TRAIN (Tax Reform for Acceleration and Inclusion) and CREATE (Corporate Recovery and Tax Incentives for Enterprises).”

“Rising prices and untamed inflation rates in the past few years all the more justify the need for a tax reform package that would reduce the income tax rates of the overburdened Filipino working class families,” the press release said.

It added “reducing income tax rates for working families will not only improve their way of life, but also strengthen their purchasing power which will boost overall domestic demand for consumer goods.”

The Duterte administration pushed for tax reforms, citing the need to amend the decades-old system, which prevented the government from efficiently collecting correct rates.

Under the TRAIN law, individuals with annual income tax of up to PHP250,000 would not be taxed starting Jan. 1, 2018 while those earning higher amounts will be taxed by a minimum of 20 percent of excess of PHP250,000.

Previously, those earning not over PHP10,000 annually were taxed 5 percent, those earning up to PHP30,000, PHP500 plus 10 percent of excess of PHP10,000, and so on.

The CREATE law, on the other hand, is the government’s pandemic relief measure for local and foreign firms operating in the country.

It aims to encourage more investors to put their funds into the domestic economy to help in the economic recovery.

For one, it reduced CIT from 30 percent to 25 percent, retroactive July 1, 2020. The rate of tax reduction will continue until it eventually ends at 20 percent starting 2027.

Economic managers from the previous administration said these measures allowed the government to collect taxes used to enhance social protection programs and the government’s infrastructure investments, among others. (PNA)