(Photo courtesy of Abra Province Facebook)

MANILA – The Government Service Insurance System (GSIS) clarified Friday that only members and pensioners from areas that have declared a state of calamity can avail of the emergency loan program.

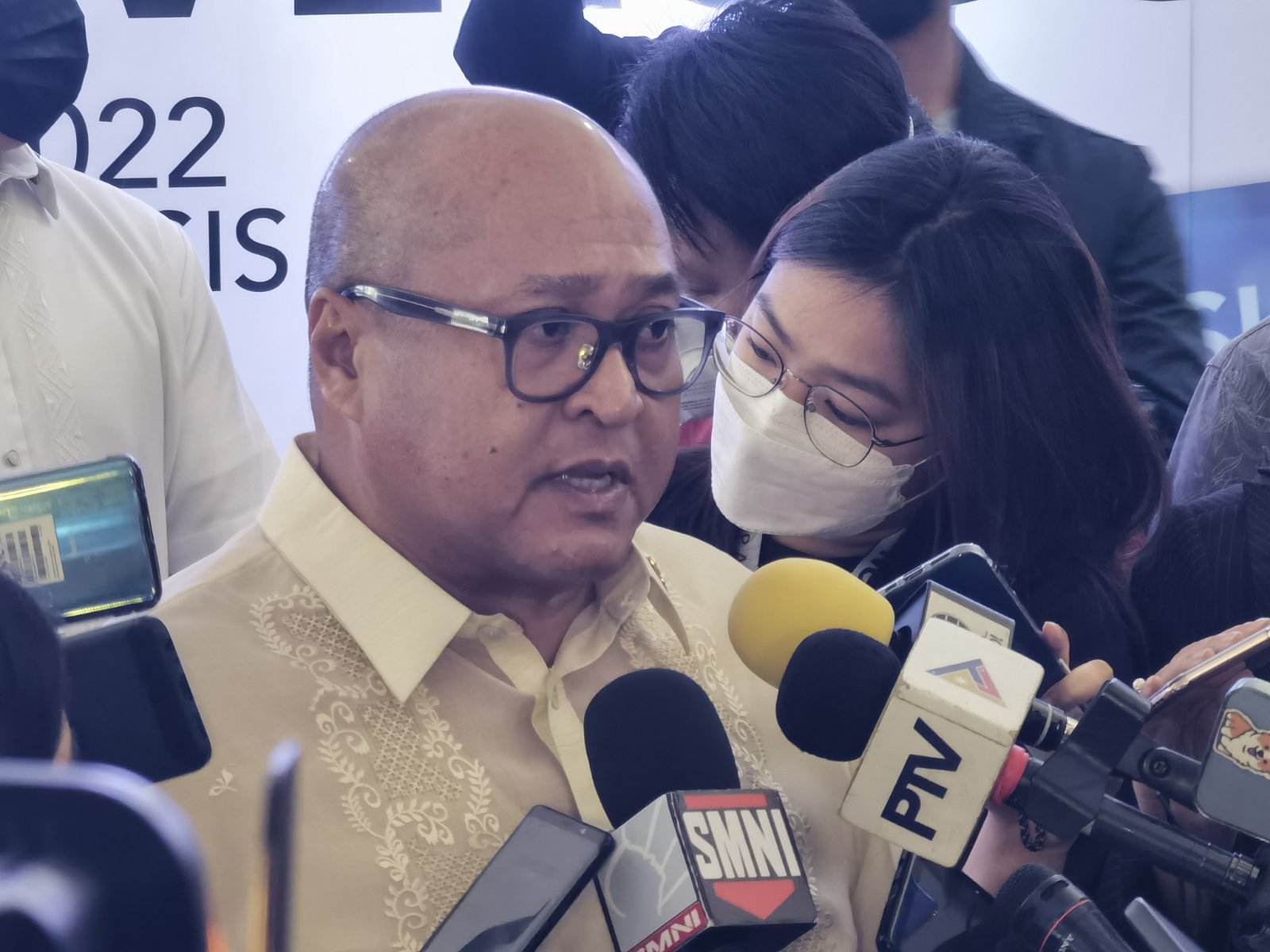

Jose Arnulfo Veloso, GSIS president and general manager, said a local government unit should declare a state of calamity first so it can have access to calamity fund.

After the magnitude 7 earthquake hit Northern Luzon, only Abra province, which has a total of 5,733 GSIS active members and pensioners, declared a state of calamity.

"Importante po na ito ay ma-trigger o ma-release at ang lugar ninyo ay na-declare (It is important that your area was declared) under a state of calamity. So far, the province of Abra has declared state of calamity and this is open to all government employees and pensioners based in the Province of Abra," Veloso said in a press briefing.

For GSIS members and pensioners coming from areas that have not declared a state of calamity, Veloso said they can apply for a multi-purpose loan.

"Sapagkat kapag ikaw ay nagkaroon ng sitwasyon na mawalan ka ng bahay o nasira ang iyong tirahan, ay importante na malaman mo na meron kang matatakbuhan agad (Because if you are in a situation wherein you lost a home or your house was destroyed, it is important that you know where to ask for help immediately) if we give you the peace of mind," he said.

GSIS has allocated PHP5.4 billion for its emergency loan program this year.

Members who have existing emergency loan balance may borrow up to PHP40,000 to pay off their previous loan and still receive a maximum net amount of PHP20,000.

For those without an existing emergency loan as well as the pensioners, GSIS announced they may apply for a PHP20,000 loan. (PNA)