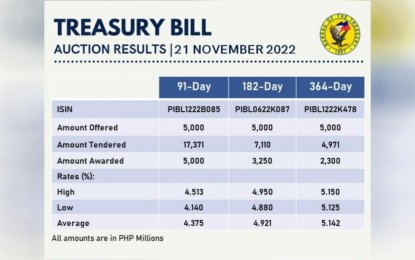

MIXED. The rate of 91-day Treasury bill (T-bill) declined on Monday (Nov. 21, 2022) while those of the 182-day and 364-day papers rose. The movements in the rate of government securities have been traced to the path of the central bank's key rates, which is currently driven by the elevated inflation rate. (Photo screenshot of auction results)

MANILA – The rates of Treasury bills (T-bills) registered mixed movements on Monday with the 91-day down, results of the auction by the Bureau of the Treasury (BTr) showed.

The average rate of the three-month paper declined to 4.375 percent from 4.464 percent during the auction last Nov. 14.

The rate of the 182-day paper rose to 4.921 percent and the 364-day paper to 5.142 percent.

These were at 4.838 percent for the six-month paper and 5.100 percent for the one-year T-bill during the auction last week.

All tenors were offered for PHP5 billion each but the one-year paper was undersubscribed after bids only amounted to PHP4.971 billion.

Total tenders for the three-month paper reached PHP17.371 billion while it reached PHP7.110 billion for the six-month.

The auction committee fully awarded the three-month paper but only PHP3.25 billion was awarded for the 182-day debt instrument and PHP2.3 billion for the one-year.

Earlier, National Treasurer Rosalia de Leon attributed the rise in government securities rates to expectations of further hikes in the central bank’s key policy rates, which was again hiked by 75 basis points last week after monetary authorities note assessments for continued elevated inflation rate. (PNA)