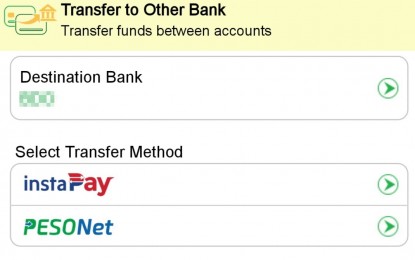

MANILA – Some 13 financial institutions and digital payment firms are waiving their PESONet and InstaPay transaction fees until end-September this year while 11 banks will do it until yearend.

In a statement Tuesday, the Bangko Sentral ng Pilipinas (BSP) released an updated list of banks that are waiving fees for electronic money (e-money) transactions in line with the regulators’ “call to strengthen the use of digital payments to help curb physical payment transactions amid the Covid-19 pandemic.”

Banks that will waive PESONet and InstaPay transaction fees until end-September this year are BDO Unibank, Inc. Metropolitan Bank & Trust Company (Metrobank), Bank of the Philippine Island (BPI), Rizal Commercial Banking Corporation (RCBC), China Banking Corporation (Chinabank), Bank of Commerce, Robinsons Bank Corporation (Robinsons Bank), Philippine Savings Bank (PSBank), China Bank Savings, Inc. (China Bank Savings), Philippine Bank of Communications (PBCOM), which is also extending the PHP1 fee due to system constraints) and Equicom Savings Bank, Inc.

The statement said PayMaya Philippines Inc. (PayMaya Philippines) and G-Xchange, Inc. (GXI) are also extending the fee waiver until end-September.

Relatively, banks that will not collect PESONet and InstaPay transaction fees until the end of this year include the Union Bank of the Philippines (Unionbank), Asia United Bank Corporation (AUB), Land Bank of the Philippines (Landbank), Development Bank of the Philippines (DBP), Security Bank Corporation (Security Bank), Sterling Bank of Asia, Inc. (Sterling Bank of Asia), Standard Chartered Bank (Standard Chartered), East West Banking Corporation (EastWest Bank), United Coconut Planters Bank (UCPB), Maybank Philippines, Inc. (Maybank), and Hong Kong and Shanghai Banking Corporation (HSBC), which waives the fees for retail customers and reduces the fees from PHP150 to PHP50 for corporate clients.

On the other hand, the BSP said Philippine National Bank (PNB), MUFG Bank, Ltd., and Bank of China-Manila branch have yet to announce their decision on the fee waiver.

Digital payments in the country posted a big jump following the implementation of the enhanced community quarantine (ECQ) in mainland Luzon from March 17 until May 15 and extended until end-May for the National Capital Region (NCR).

Other local governments outside of Luzon also implemented community quarantines to address the rise of coronavirus disease (Covid-19) infections.

BSP Governor Benjamin Diokno said the rise of e-money transfers and e-money payment transactions since mid-March makes monetary authorities confident of hitting their goal to have about 70 percent of adult Filipinos to be part of the formal financial system, by having at least basic deposit accounts, by 2023.

He earlier said that about 3.8 million deposit accounts were opened during the ECQ in line with the government’s social amelioration program (SAP) while about 4 million accounts were opened digitally between March 17 and end-April. (PNA)