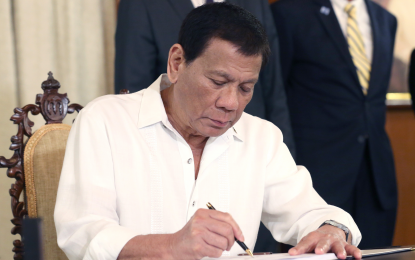

(Presidential photo)

MANILA – President Rodrigo Duterte has signed Republic Act (RA) 11523 or the Financial Institutions Strategic Transfer (FIST) Act in a bid to keep the financial sector stable amid the coronavirus disease 2019 (Covid-19) pandemic, Malacañang announced on Wednesday.

“We consider the enactment of RA 11523 timely and thank both Houses of Congress for the passage of this law, which has been certified urgent by the Chief Executive and has been considered by our Economic Team as one of the measures that would help us recover in the aftermath of (the) Covid-19 pandemic,” Presidential Spokesperson Harry Roque said in a statement.

The FIST Act is among Duterte’s priority legislation touted as his administration’s stimulus measures to help the Philippine economy recover from the pandemic shock.

The new law allows banks and financial institutions to outsource the management of their non-performing assets (NPAs) and non-performing loans (NPLs) to asset management firms that are similar to special purpose vehicles (SPV).

Roque said the signing of the law would put the economy on a “more solid path to recovery.”

“As part of the economic recovery program of the Duterte administration, FIST will strengthen the financial sector by enabling banks to efficiently dispose of their non-performing loans and assets, clean up their balance sheets, and extend credit to more sectors in need,” he said.

RA 11523, inked by Duterte on February 16, is seen as an improved version of the SPV Act of 2002, which was enacted in response to the Asian financial crisis.

Under the newly signed law, financial institutions' strategic transfer corporations (FISTC) will have the powers to invest in or acquire the NPAs of financial institutions and engage third parties to manage, operate, collect, and dispose of NPAs acquired from a financial institution.

According to the law, FISTCs can also rent, lease, hire, subject to security interest, mortgage, transfer, sell, exchange, usufruct, secure, securitize, and collect rents and profits concerning its NPAs acquired from a financial institution.

A FISTC should have a minimum authorized capital stock of PHP500 million with a minimum subscribed capital stock of PHP125 million, and a minimum of paid-up capital of PHP31.25 million.

RA 11523 requires the submission of a FISTC plan, which needs to secure approval.

No transfer of NPLs to a FISTC should take effect, unless the concerned financial institution gives prior notice to the borrowers of the NPLs and all persons holding prior encumbrances upon the assets mortgaged or subject to security interest.

The transfer of NPAs to a FISTC or a third party will be exempt from documentary stamp tax, capital gains tax, creditable withholding income taxes, and value-added tax.

To encourage the infusion of capital and financial assistance by the FISTC, the corporation will be exempt from income tax on net interest income, documentary stamp tax, and mortgage registration fees on new loans in excess of existing loans extended to borrowers with NPLs that have been acquired.

In case of capital infusion by the FISTC to the borrowers, the FISTC will also be exempt from the documentary stamp tax.

“The tax exemptions and fee privileges granted under this section shall apply for a period of not more than five years from the date of acquisition of NPLs by the FISTC,” RA 11523 read.

Data from the Bangko Sentral ng Pilipinas (BSP) show that gross NPLs in the banking system has climbed to PHP391.657 billion, or 3.61 percent of total loans, as of December 2020.

NPLs increased by 74.8 percent from PHP224.1 billion in 2019.

Malacañang released a copy of the law on Wednesday.

The law takes effect immediately after its publication in the Official Gazette and a newspaper of general circulation. (PNA)