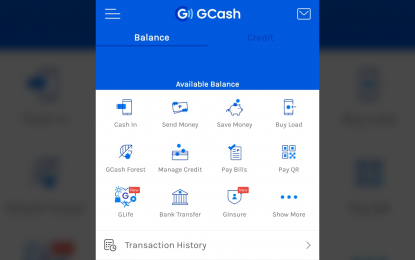

(Screenshot of GCash mobile app)

MANILA – Mobile wallet and banking service provider GCash said minors and other persons unable to complete its verification process will have limited access to its services, with restrictions to services such as Pitmasters or ‘e-Sabong’.

In a statement on Tuesday, GCash assured “strict compliance” with the guidelines of the Bangko Sentral ng Pilipinas and the Anti-Money Laundering Council through various measures including the “Know-Your-Customer” (KYC) process to verify the legitimacy of customers.

“On top of a best-in-class KYC screening feature, we have additional safety measures in place to prevent unverified individuals from using our channel for e-Sabong, despite the fact that similar online and even offline channels offer the same service without stringent guidelines in place,” the statement read.

While minors remain able to register for GCash, they will be unable to use most of the mobile wallet’s features unless through illegal means.

“The only way those below the legal age can possibly use GCash for this service is through unsupervised use of an adult account by a minor or access through mule accounts which are rented, illegally sold, or falsified -- all of which are punishable by law,” the statement read.

Persons with criminal intent cannot be completely prevented from selling, renting out, or allowing others to use false identities on GCash and called on the public to protect their identities and accounts.

“Report any incident of misuse to relevant partner authorities including the Philippine National Police and National Bureau of Investigation,” GCash said.

To date, the overall transaction value over GCash has grown from PHP300 billion in 2019 to more than PHP3 trillion in 2021.

“GCash achieved massive and exponential growth in the last couple of years and this is attributed to the myriad of innovative products and services offered to provide everyday digital financial solutions for Filipinos,” GCash said.

Aside from online payments and money transfers, GCash allows its users to utilize savings, insurance and investment products, lending, and other financial services. (PNA)