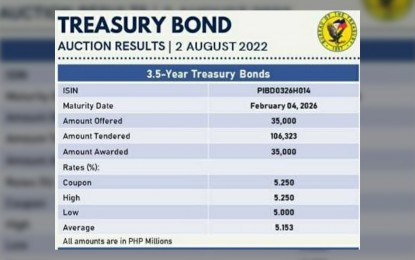

GOV’T SECURITIES YIELD. Recession worries dampen the rise of interest rates, resulting in the decline of the 3.5-year Treasury bond (T-bond) rate on Tuesday (Aug. 2, 2022). An economist said concerns on the possible recession in the US have led to the decline in the prices of oil and other commodities in the international market, which has also affected the path of government securities yield both here and in the US. (Photo grabbed from BTr Facebook page)

MANILA – The rate of 3.5-year Treasury bond (T-bond) declined on Tuesday, which an economist said is in line with latest developments on government security yields both here and in the US.

The average rate of the debt paper slipped to 5.153 percent from 5.908 percent previously.

The Bureau of the Treasury (BTr) offered the T-bond for PHP35 billion and the auction committee made a full award. Total tenders were more than three times at PHP106.323 billion.

Rizal Commercial Banking Corporation (RCBC) chief economist Michael Ricafort told the Philippine News Agency the rate of the debt paper is consistent with the comparable rate of the three-year tenor in the secondary market at 5.11 percent and the four-year tenor at 5.38 percent.

“(The) strong demand for T-bond/FXTN (fixed rate treasury notes) auctions recently (is) consistent with the easing of long-end PHP BVAL (Bloomberg Valuation Service) yields in line with the similar easing in long-term US Treasury yields amid signals of possible recession that led to lower global oil and other commodity prices,” he said.

Ricafort said indications of possible recession in the US, the world’s largest economy, not only lowers global oil and commodity prices but “could help ease inflationary pressures, fundamentally leading to the healthy downward correction in US/global/local long-term interest rates/bond yields after reaching new pre-pandemic highs in June 2022.”

“The downward correction in US dollar vs. global/Asian/Asean currencies recently that led to the recent appreciation of the peso to the strongest in nearly a month also supported sentiment in the local financial markets, including the recent easing in long-term local government securities yields,” he added. (PNA)