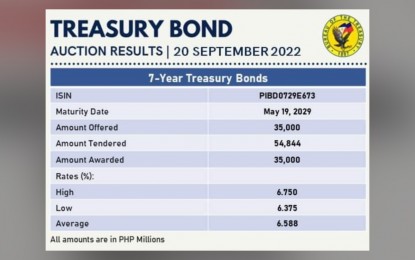

RATE SLIPS. The average rate of seven-year Treasury bond (T-bond) declined on Tuesday (Sept. 20, 2022), which National Treasurer Rosalia de Leon said was within the rates in the secondary market. The drop in the debt paper's yield is a change from the past auctions wherein investors demanded for higher rates given the sustained jumps in interest rates both here and in the US, among others. (Photo grabbed from BTr's Facebook page)

MANILA – The average rate of seven-year Treasury bond (T-bond) slipped on Tuesday, which National Treasurer Rosalia de Leon said was in line with those of the secondary market.

The rate of the debt paper declined to 6.588 percent from 6.740 percent previously.

The Bureau of the Treasury (BTr) offered the debt instrument for PHP35 billion and the auction committee made a full award. Total bids reached PHP54.844 billion.

“Rates are aligned with the secondary levels,” de Leon told journalists in a Viber message.

This outcome of the T-bond auction is a change compared with the past auctions wherein rates were on the upward trend.

De Leon earlier said the upticks in rates of government securities are attributed to investors’ anticipations for continued hikes in the Federal Reserve’s key rates, as US monetary authorities address the world’s largest economy’s elevated inflation rate, which to date is at its four-decade high.

The jumps in Fed’s rates have resulted in, among others, the weakening of the Philippine peso.

The Bangko Sentral ng Pilipinas has also increased its own policy rates to address not only the peso’s depreciation, but also the elevated inflation rate in the domestic economy. (PNA)