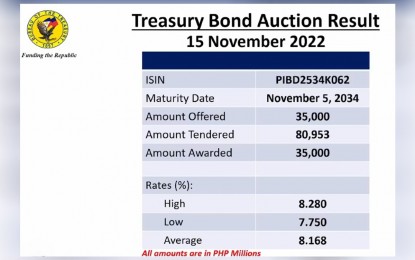

HIGHER YIELD. The Bureau of the Treasury (BTr) fully awarded for PHP35 billion the 12-year Treasury bond (T-bond) on Tuesday (Nov. 15, 2022) even with the rate that was higher than in the secondary market. National Treasurer Rosalia de Leon traced the rate uptick to the looming increase in the Bangko Sentral ng Pilipinas' (BSP) key rates this week. (Photo screenshot of auction results)

MANILA – The rate of 12-year Treasury bond (T-bond) auctioned by the Bureau of the Treasury (BTr) on Tuesday surpassed secondary rates but was fully awarded.

The average rate of the debt paper stood at 8.168 percent, which National Treasurer Rosalia de Leon said is higher than in the secondaries.

The BTr offered it for PHP35 billion and tenders were more than two-fold at PHP80.953 billion.

The T-bond was originally a 25-year tenor paper but has a remaining life of 11 years and 11 months.

“(The) average (rate) while higher than (in the) secondary (market) already provides for policy rate hike to be delivered by the MB (Monetary Board),” de Leon told journalists in a Viber message.

She said the BTr opened the tap facility window to reoffer the T-bond during the day for PHP5 billion.

The Bangko Sentral ng Pilipinas’ (BSP) policy-making Monetary Board will have its seventh rate-setting meeting this Thursday.

Earlier, BSP Governor Felipe Medalla, who chairs the seven-man MB, said they will again increase the central bank’s policy rates by 75 basis points following the same increase in the Federal Reserve’s key rates earlier this month to ensure interest rate differential between the United States and the Philippines.

Medalla said continued hikes in the BSP’s key rates are possible in line with the central bank’s price stability mandate, as well as to protect the peso from further depreciating against the US dollar. (PNA)