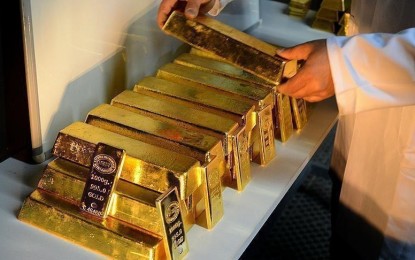

ANKARA – Global gold demand hit a new decade-high of 4,741 tons in 2022, thanks to robust central bank-buying and strong retail investment during the last quarter.

According to the Gold Demand Trends report from the World Gold Council on Tuesday, gold demand rose 18 percent from the previous year.

"Last year we saw the highest level of annual gold demand in over a decade, driven in part by colossal central bank demand for the safe haven asset," said Louise Street, senior markets analyst from the World Gold Council.

Central bank demand surged 152 percent year-on-year to 1,136 tons in 2022, a 55-year record high, the council said, adding "the majority of which was unreported."

Investment demand (excluding over-the-counter) increased 10 percent from a year earlier to 1,107 tons in 2022, led by a notable slowdown in exchange-traded fund (ETF) outflows and strong gold bar and coin demand.

"Gold’s diverse demand drivers played a balancing act as rising interest rates prompted some tactical ETF outflows, while elevated inflation spurred on gold bar and coin investment," Street said.

Jewelry consumption decreased 3 percent to 2,086 tons last year due to hike in gold prices in the fourth quarter.

Demand for gold in technology dropped 7 percent in 2022 as deteriorating global economic conditions hampered demand for consumer electronics.

Total annual gold supply ticked up 2 percent annually to 4,755 tons in 2022, while mine production rose to a four-year high of 3,612 tons. (Anadolu)