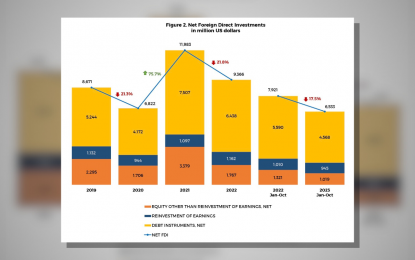

FDI. The chart shows the Philippines' performance in net foreign direct investments (FDIs) since 2019. From January to October 2023, the country netted FDI inflows amounting to USD6.5 billion. (Courtesy of Bangko Sentral ng Pilipinas)

MANILA – The net value of inward direct investments by foreign investors into the Philippines amounted to USD6.5 billion from January to October 2023, the Bangko Sentral ng Pilipinas (BSP) reported Wednesday.

The BSP said net foreign direct investment (FDI) inflows in the first 10 months last year fell by 17.9 percent from USD7.9 billion in the same period in 2022.

The central bank pointed out that the decline can be attributed to the adverse impact of persistent inflationary pressures and the easing of global growth prospects on investors’ decisions.

For the same period, the country’s top sources of FDIs include Japan, the United States, Singapore, and Germany.

A big chunk of these FDIs went to the manufacturing sector, sharing 50 percent of the pie, followed by real estate at 14 percent, and the financial and insurance sector at 12 percent.

For October 2023 alone, net FDI inflows dropped 29.6 percent to USD655 million from net inflows of USD930 million in October 2022.

“This was due largely to the 26.1 percent decrease in net investments in debt instruments to USD504 million from USD682 million. Non-residents’ net investments in equity capital (other than reinvestment of earnings) and reinvestment of earnings also declined by 54.4 percent and 10.3 percent to USD74 million (from USD163 million) and USD76 million (from USD85 million), respectively,” the BSP added.

Majority of the FDIs in October last year were from Japan, US, and Singapore.

In a briefing in Taguig City on Wednesday, HSBC economist Aris Dacanay said the policies made by the administration in late 2022 and early 2023 “beefed up the attractiveness of the Philippine economy in attracting FDIs,” especially in the renewable energy (RE) sector despite the decline in net FDI inflows in the first 10 months of last year.

Dacanay is also optimistic that these policies, especially allowing 100 percent foreign ownership in RE projects, will help in luring foreign investors to put in their capital in the renewables sector.

“We also have a big gap when it comes to energy. So, we do have a big gap to fill,” he added.

With these investment opportunities here, Dacanay said he believes that the Philippines could achieve its aspiration of becoming the second largest hub of FDIs in ASEAN before the Marcos administration ends.

In the first three quarters last year, the Philippines exceeded the net FDI inflows of Malaysia and Indonesia. (PNA)