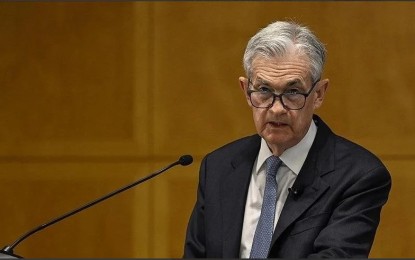

MORE SIGNS. Federal Reserve Chair Jerome Powell said "more evidence" are needed before the central bank cut its key rates. He said inflation rate has significantly decelerated but remains above the central bank’s 2 percent goal. (Anadolu)

ISTANBUL – US Federal Reserve Chairman Jerome Powell said he needs to see "more evidence" before the central bank starts to lower interest rates.

"Over the past year, inflation has come down significantly but is still running above the Federal Open Market Committee's (FOMC) 2 percent goal," he said Wednesday at the Stanford Business, Government, and Society Forum at Stanford Graduate School of Business in the US state of California.

"Tight monetary policy continues to weigh on demand, particularly in interest-sensitive spending categories. Nonetheless, growth in economic activity and employment was strong in 2023, as real gross domestic product expanded more than 3 percent and three million jobs were created, even as inflation fell substantially," he said.

Powell added that the FOMC does not expect to lower its monetary policy rate until it has "greater confidence" that inflation is sustainably moving toward its 2 percent target.

The Fed has kept interest rates steady, having the federal funds rate unchanged between the 5.25 percent- 5.5 percent target range -- the highest in 23 years. (Anadolu)